What is Cryogenic Deflashing ?

Moulded or machine-created parts are used often in modern items. However one that I had not previously been aware of was the huge issue of how to get rid of the excess on the circumference. Looking for a reliable source for custom deflashing of your rubber molded products?

On these manufactured use – burrs as it’s also known as is basically the unwanted part of the material. It is created when a polymer with viscoelasticity is produced by injection or compression moulding for instance. It’s normally what is left usually along the mold parting line during the production process. This needs deburring and to be removed from the finished item or parts. Removing this efficiently and accurately can be a difficult job especially in industries that demand high performance products.’

How Can it Be Removed ?

- Manually by operatives using knives, scissors or cutting devices.

- Manually tearing whilst at the mold stage

- Die Punching (displacing unwanted material)

- Cryogenic Deflashing

Most of the modern factories across the world use some of these procedures, however the finish left by these methods varies hugely. The other important factor is of course cost as this process can add significant expense depending on which one used and the finish required. If you’ve looked at even basic deflashing equipment you’ll see why it can be a significant capital cost for smaller businesses.

Removing by Manual Trimming

For years the majority of companies would have employees cutting or removing around trim beads around the edge of the product. This was widely used because the capital cost is initially low – a mobile worker with a knife or scissors. Yet obviously the method is extremely labour intensive and indirect costs can quickly escalate. Although in small units especially rubber flash removal can be achieved quite accurately, it’s obviously extremely time consuming. Obviously there is also the question of the standard of finish which along with production rates will vary hugely depending on both the employee and the dimensions of the finished part.

Die Punching

This method to remove the excess is slightly more sophisticated and easier to fit into a fast production process. It involves placing the moulded product into a specially prepared die prepared from the finished product. The technique involves pushing the product onto the mode in order to remove the excess flash from around the corners. The method is often described as the cookie cutter method as it operates in a very similar way to cutting dough.

The advantages are that quality is much more consistent than the manual method and capital costs are kept relatively low. However it’s often difficult to integrate effectively into a production process as it is relatively labour intensive which obviously effects output.

How Does Cryogenic Deflashing Work

Slowly though doing this manually is becoming outdated and they have been superseded. The latest innovations have various implementations and is often a safely guarded secret. However the concept is widely accepted as being by far the superior method of removing flash from any high value product.

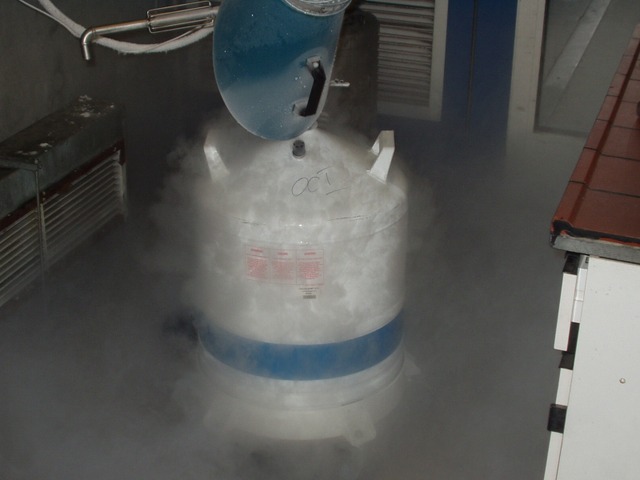

Cryogenic deflashing (see reference) involves using very low temperatures as an aid to removing excess waste from the edges. The central process involves utilizing a substance which create very low temperatures such as liquid nitrogen. This is used to make the rubber or plastic (or sometimes other materials such as aluminium) brittle. Cryogenic deflashing is a system that uses the extremely low temperature of a cryogen such as liquid nitrogen (LIN) to remove flash. It basically utilizes very low temperatures of a cryogen such as nitrogen (in a liquid form).

Here’s a simple demonstration –

Media blasting normally involves firing small particles of abrasive materials (blast media) at the target edges. When this is conducted at a high velocity it can be very effective and accurate in removing the flash. Tumbling can ensure that the blast media is distributed uniformly over the entire surface. Both these methods can be used on internal and external parts depending on the equipment used.

Importance of Media used with Cryogenic Deflashing

Arguably of the most crucial importance, are both media and size used in the deflashing process. The durability and effectiveness of the media used can affect both the quality and the cost. For example some media will create large amounts of dust which can cause huge quality issues especially when combined with fragile components.

Even the geometrical properties of the media will severely impact the process and can be crucial in creating a high standard end product. Often this media will need to be customized to work best with a specific plastic deflashing machine or for use on a particular item.

There are companies who operate and indeed specialize in producing and supplying the media required for an efficient and effective deflashing process whether cryogenic or using other methods like thermal energy deflashing.